⏲️ Estimated reading time: 4 min

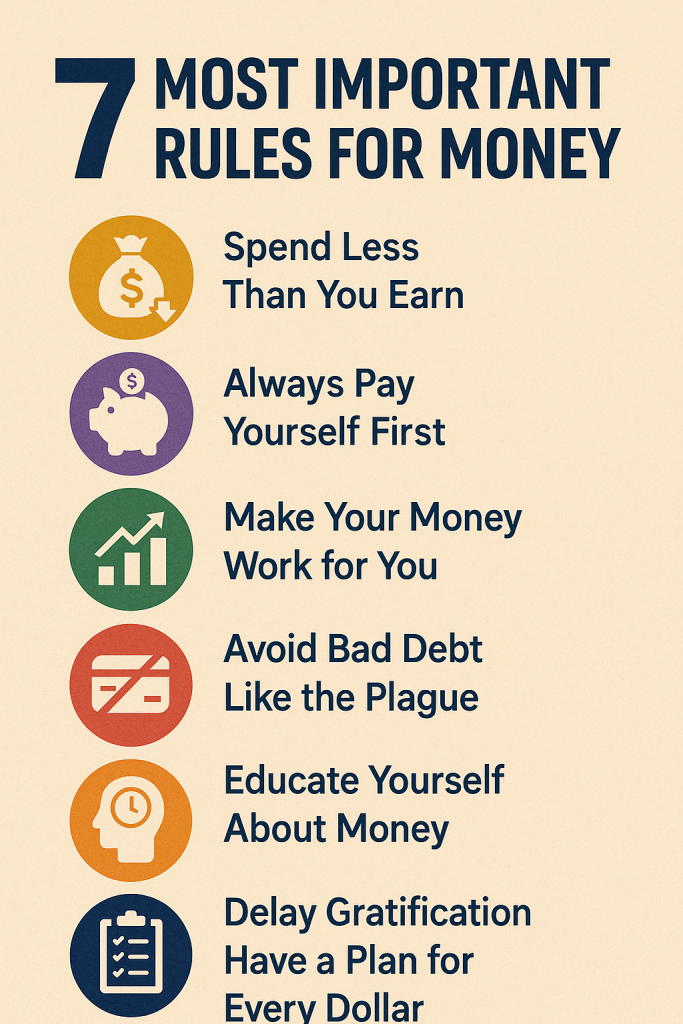

7 Most Important Rules for Money. Mastering your finances starts with a few powerful rules. These 7 essential money principles will guide you toward financial freedom, security, and smarter decisions. Apply them consistently and watch your financial life transform step by step.

7 Most Important Rules for Money You Should Never Ignore

Money plays a central role in modern life, yet most people were never taught how to handle it wisely. Whether you’re trying to save, invest, or simply live stress-free, understanding these 7 fundamental rules can make all the difference. Let’s dive into the core financial principles that shape wealthy lives.

💰 1. Spend Less Than You Earn

This is the golden rule of personal finance. No matter how much you make, if your expenses are higher than your income, you’re digging a financial hole. To apply this rule:

- Track your income and expenses monthly

- Set a budget and stick to it

- Avoid lifestyle inflation

Small daily choices, like making coffee at home or avoiding impulse buys, can add up to big savings over time.

🏦 2. Always Pay Yourself First

Before you pay rent, bills, or go shopping, pay your future self by saving a portion of your income. Ideally, save at least 10% to 20% of your monthly earnings automatically.

Ways to apply this:

- Automate savings transfers each payday

- Build an emergency fund of 3–6 months of expenses

- Use high-yield savings or investment accounts

Paying yourself first turns saving from an afterthought into a priority.

📈 3. Make Your Money Work for You

Wealthy people don’t just work for money they make money work for them. This means investing instead of letting your savings sit idle.

Smart ways to invest include:

- Index funds and ETFs for long-term growth

- Real estate for passive income

- Dividend-paying stocks

Even if you start small, the power of compound interest will grow your wealth exponentially over time.

💳 4. Avoid Bad Debt Like the Plague

Debt can be a tool or a trap. Good debt (like a mortgage or student loan with low interest) may help build value. Bad debt (like credit cards or payday loans) eats your wealth.

To manage debt wisely:

- Pay off high-interest debts first (snowball or avalanche method)

- Avoid borrowing for wants instead of needs

- Don’t carry balances on credit cards if possible

If you use credit, treat it like cash and pay it in full every month.

📚 5. Educate Yourself About Money

Financial literacy is the key to unlocking opportunities. Don’t rely on luck or guesswork build knowledge to make better decisions.

Start by:

- Reading personal finance books like “The Richest Man in Babylon” or “Your Money or Your Life”

- Watching educational YouTube channels or podcasts

- Learning the basics of taxes, investing, and budgeting

When you know how money works, you’re less likely to be manipulated or misled.

🧠 6. Delay Gratification

This rule is the secret sauce behind wealth-building. People who succeed financially know how to resist short-term temptations for long-term gains.

Tips to apply:

- Sleep on major purchases (24–48 hours rule)

- Set financial goals and review them often

- Visualize what you’re saving for (freedom, a house, travel)

Remember: Financial freedom is far more satisfying than the latest gadget.

📊 7. Have a Plan for Every Dollar

Every dollar you earn should have a purpose. This is the essence of intentional money management. A financial plan doesn’t restrict you it empowers you.

Create a plan by:

- Setting clear short-term and long-term goals

- Using tools like zero-based budgeting or envelope systems

- Revisiting your financial plan quarterly

When you plan your money, you control your future.

💡 Conclusion

Mastering money doesn’t require a finance degree or a six-figure income. It requires discipline, intention, and a commitment to following timeless rules that actually work. These seven principles are your foundation build on them, and your financial life will grow stronger every day.

🔔For more tutorials like this, consider subscribing to our blog.

📩 Do you have questions or suggestions? Leave a comment or contact us!

🏷️ Tags: personal finance, budgeting, saving money, investing, debt management, financial planning, money habits, financial literacy, smart money, passive income

📢 Hashtags: #MoneyRules, #FinancialFreedom, #SaveSmart, #InvestWisely, #MoneyMindset, #BudgetTips, #DebtFreeJourney, #MoneyGoals, #FinancialEducation, #WealthBuilding

Only logged-in users can submit reports.

Discover more from HelpZone

Subscribe to get the latest posts sent to your email.